Commandez en ligne vos lentilles de contact chez l'Atelier de l'Opticien - Opticien Marseille La Valentine - Magasin lunettes de vue et soleil - L'Atelier de l'Opticien

💰Acheter des produits de la catégorie Eyeshare 2pcs/1 Paire Halloween Lentilles de contact annuellement jetables lentilles douces lentilles colorées pour cosplay anime yeux au meilleur prix dans la boutique en ligne Joom —

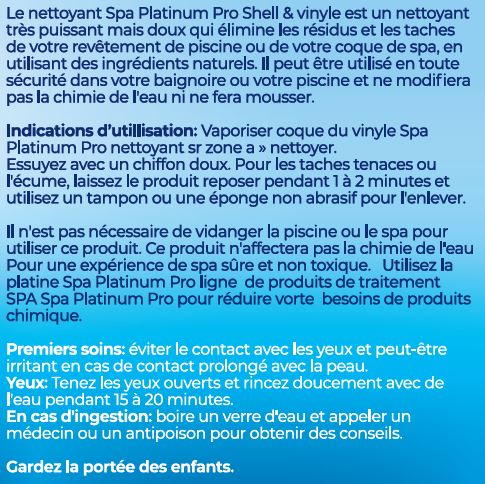

Natural Vinyl & Shell Cleaner - Spa Platinum Pro. Hot tub, spa and pool products, all made with natural ingredients