Diy Die Cut Handmade Baby Wool Felt Fabric Flower Decorate Headband - Buy Felt Flower,Felt Rose Flowers,Handmade Felt Flower Product on Alibaba.com

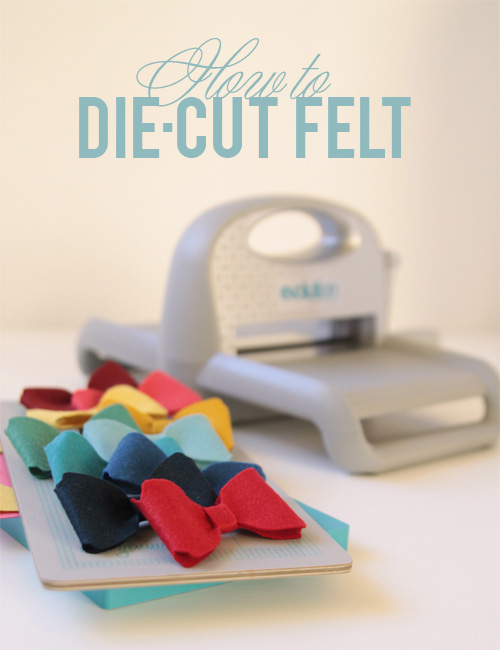

Chzimade Mini Die Cutting Embossing Machine Scrapbooking Dies Cutter Piece Die Paper Felt Fabric Cut Machine Diy Home Decor - Die-cut Machines - AliExpress

Amazon.com: Black Adhesive Felt Circles: Variety of Sizes: 2”, 3”, 4” or 5" Wide; Die Cut Felt Stickers for DIY Projects & Professional Craft Finishing (Single Package of 20, 3 Inch Circles)

Wool Blend 3d Felt Roses Die Cut Applique Felt Fabric Flowers - Buy Felt Flower,Felt Rose,Wool Felt Flower Product on Alibaba.com

Amazon.com: Felt Sheets for Crafts 9x12.Acrylic Sheets Art and Craft Material.Fabric Craft Supplies,Gift Wrapping Supplies,Fabric Felt for Crafts,Sewing,Halloween Costumes-6PC Felt Fabric Autumn Orange Felt Paper

Salina Studio A5 Felt Fabric Leather Cardboard Cutting Machine Paper Die Cutters for Crafts Embossing Scrapbooking New 2022 - AliExpress

Salina Studio A5 Felt Fabric Leather Cardboard Cutting Machine Paper Die Cutters for Crafts Embossing Scrapbooking New 2022 - AliExpress