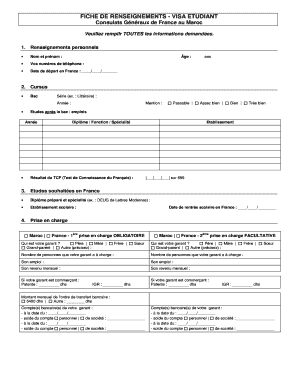

![Study in France]*2021 Most Complete Hong Kong Version* How to Apply for a French Student Visa? Interview process, preparation documents French Student Visa VLS-TS - Cake Ensoleillé Wind and sunshine Study in France]*2021 Most Complete Hong Kong Version* How to Apply for a French Student Visa? Interview process, preparation documents French Student Visa VLS-TS - Cake Ensoleillé Wind and sunshine](https://cakeensoleille.com/wp-content/uploads/2022/04/visa-schengen.jpg)

Study in France]*2021 Most Complete Hong Kong Version* How to Apply for a French Student Visa? Interview process, preparation documents French Student Visa VLS-TS - Cake Ensoleillé Wind and sunshine

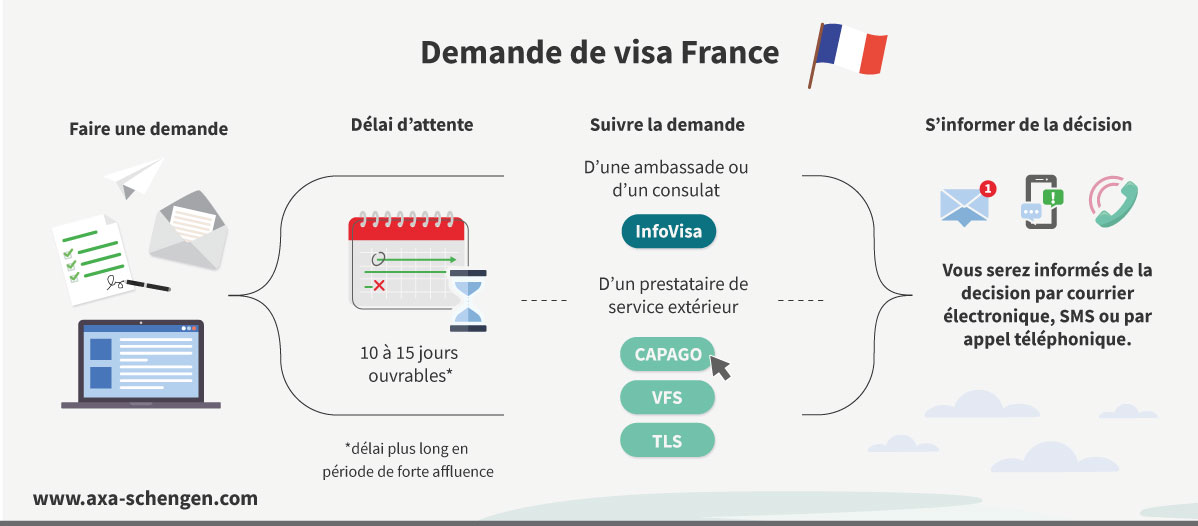

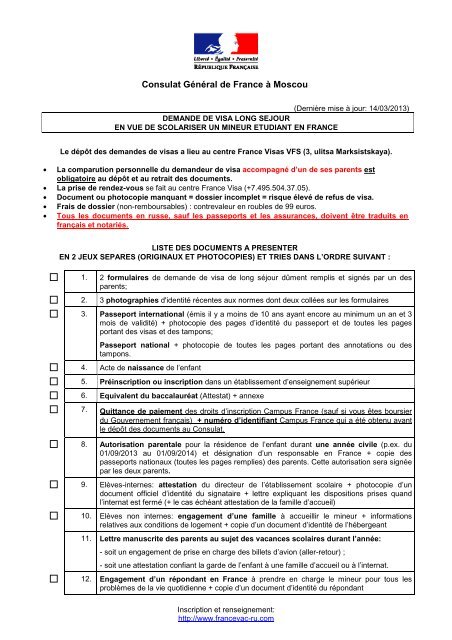

DOCUMENTS À PRODUIRE VOUS VOULEZ EFFECTUER UN LONG SEJOUR EN FRANCE POUR VOS ETUDES Formulaires Ressources

![Comment prendre un rendez-vous ? - Visa Schengen [France]- [FR] - YouTube Comment prendre un rendez-vous ? - Visa Schengen [France]- [FR] - YouTube](https://i.ytimg.com/vi/JuiTtLqI5uU/maxresdefault.jpg)