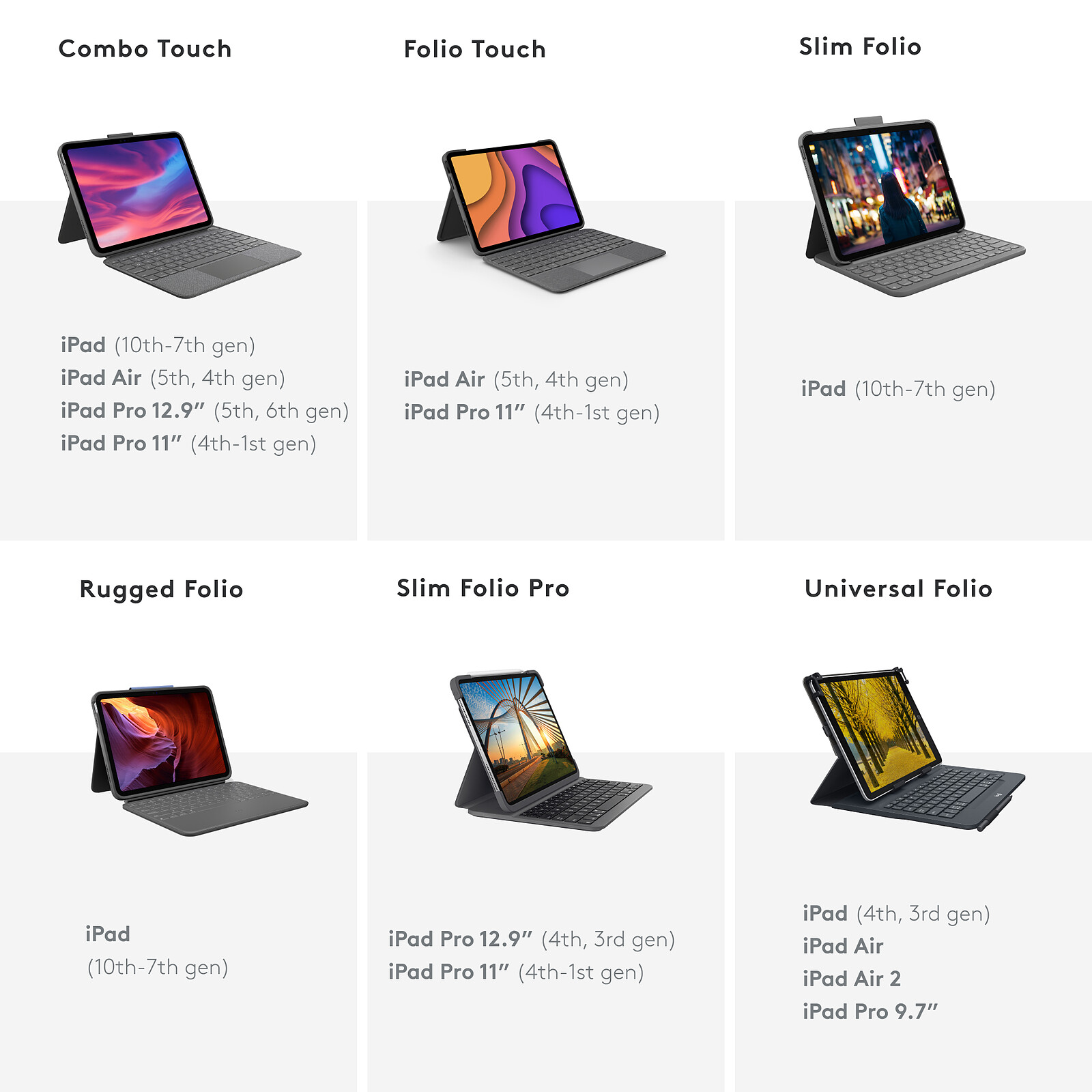

Étui clavier Combo Touch avec trackpad pour iPad Pro 12,9 pouces 6e génération/11 pouces 4e génération et iPad Air 5e génération

Logitech Combo Touch - iPad (7e, 8e et 9e génération), iPad Air (3e génération) et iPad Pro 10,5 pouces - Accessoires tablette tactile Logitech sur Materiel.net

Clavier pour tablette Logitech Étui clavier intégré Universel Folio Gris pour Tablettes 9-10" ou iPad 4émé , 3eme génération , Ipad Air / Air 2/ PRO 9.7 - KB 10 UNIV - Darty

Logitech Blok Étui de Protection avec clavier AZERTY détachable pour iPad Air 2 Turquoise/Bleu : Amazon.fr: Informatique

Etui de protection en toile Logitech avec clavier français Bluetooth intégré pour iPad Air 2 - Rouge : Amazon.fr: Informatique

Logitech Type+ - Clavier et étui - Bluetooth - Français - noir de charbon - Claviers pour tablette - Achat & prix | fnac

Étui clavier Combo Touch avec trackpad pour iPad Pro 12,9 pouces 6e génération/11 pouces 4e génération et iPad Air 5e génération

Logitech Étui de protection avec clavier intégré pour iPad Air 2 (CH-clavier) - noir | STEG-Electronics.ch

Logitech Folio Touch Étui Clavier avec Trackpad et Smart Connector pour iPad Pro 11" (1re, 2e, 3e, 4e génération) - Etui tablette Logitech sur LDLC