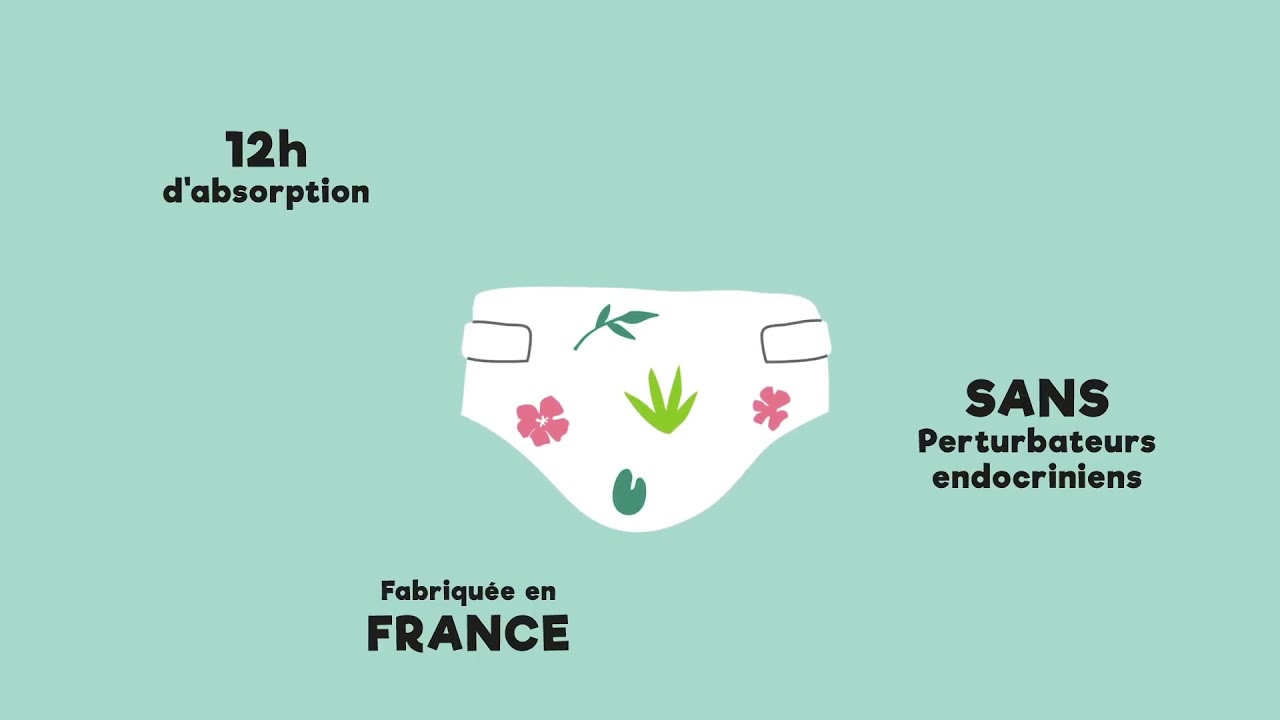

Pampers Couches Taille 7 (15+ kg), Baby-Dry, 112 Couches Bébé, Pack 1 Mois, Jusqu'à 12h Bien Au Sec et Avec Double-Barrière Anti-Fuites : Amazon.fr: Hygiène et Santé

Pampers Couches Taille 7 (15+ kg), Baby-Dry, 112 Couches Bébé, Pack 1 Mois, Jusqu'à 12h Bien Au Sec et Avec Double-Barrière Anti-Fuites : Amazon.fr: Hygiène et Santé

Pampers Couches Taille 7 (15+ kg), Baby-Dry, 112 Couches Bébé, Pack 1 Mois, Jusqu'à 12h Bien Au Sec et Avec Double-Barrière Anti-Fuites : Amazon.fr: Hygiène et Santé

Pampers Couches-Culottes Taille 7 (17+ kg), Baby-Dry, 104 Couches-Culottes Bébé, Pack 1 Mois, Maintien 360° pour Éviter les Fuites, Faciles à Changer : Amazon.fr: Bébé et Puériculture

Pampers Harmonie Hybrid, 108 Cœurs de Protection Jetables pour Couche Lavable Hybride, 100% d'Absorption, Protège la Peau Sensible des Bébés, Ingrédients d'Origine Végétale et sans Parfum : Amazon.fr: Bébé et Puériculture

Pampers Couches Taille 7 (15+ kg), Baby-Dry, 112 Couches Bébé, Pack 1 Mois, Jusqu'à 12h Bien Au Sec et Avec Double-Barrière Anti-Fuites : Amazon.fr: Hygiène et Santé

Pampers Harmonie Hybrid, Kit d'Essai 1 Couche Lavable + 15 Cœurs de Protection Jetables, Absorption Normale, Protège la Peau Sensible des Bébés, Avec des Ingrédients d'Origine Végétale et 0% Parfum : Amazon.fr:

Pampers Couches Taille 1 (2-5 kg), Harmonie, 140 Couches Bébé (Lot de 4 x 35), 0% de compromis, 100% d'absorption, Ingrédients d'origine végétale, Hypoallergéniques : Amazon.fr: Bébé et Puériculture

Pampers Couches Taille 7 (15+ kg), Baby-Dry, 112 Couches Bébé, Pack 1 Mois, Jusqu'à 12h Bien Au Sec et Avec Double-Barrière Anti-Fuites : Amazon.fr: Hygiène et Santé