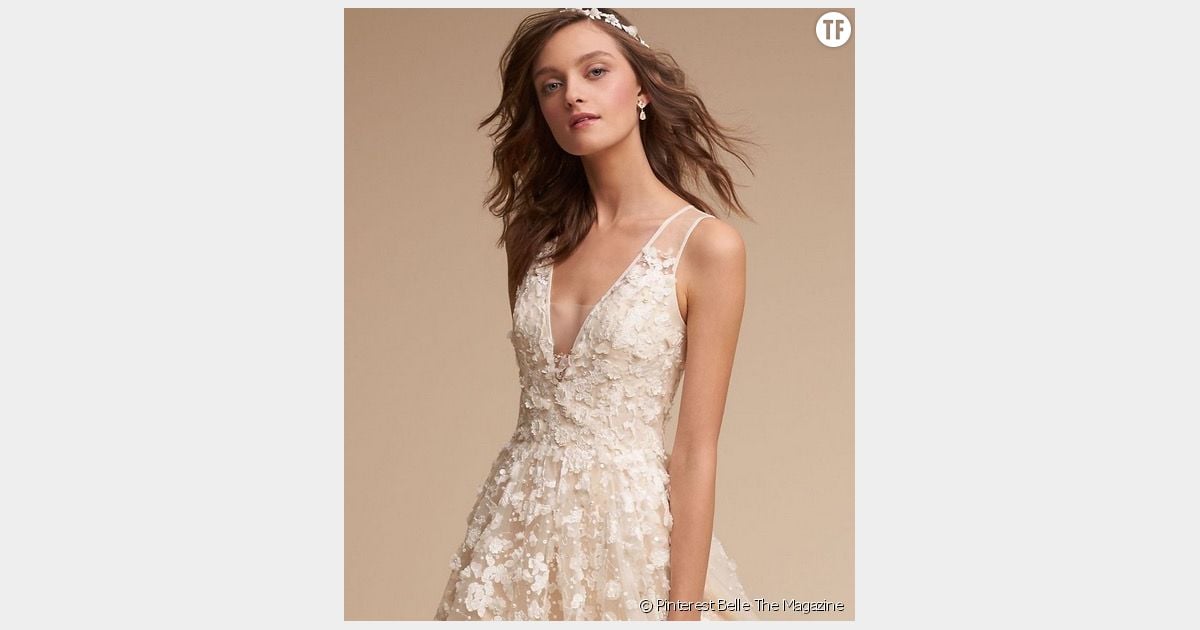

Robe de mariée princesse couleur Champagne avec broderies - A&K Fashion Shop - Vente en ligne de robes de mariée et de soirée sur-mesure

Robe de mariée 2021 nouveau champagne couleur mariée maternité Mori système petite lumière maître 2021 tempérament rêve ro Blanc - Cdiscount Prêt-à-Porter

ravissante robe de mariée couleur champagne bustier dentelle et longue traîne - Ref M391 - Robes de mariée