Un Gros Tuyau Pour Le Pétrole. Le Tuyau S'infiltre Dans Le Sol Image stock - Image du industriel, environnementalisme: 224694099

8415 DéVIDOIR DE TUYAU ZECA SéRIE 8400 POUR LE PéTROLE ET LE DIESEL 15 BAR TUYAU DE 8 M - DIAM INT TUYAU DE 19 MM

Tuyau De Refroidissement Universel Pour Gaz De Pétrole Et Carburant, Argent, 10 Pieds, Tube De Refroidissement En Ptfe, En Acier Inoxydable, Double Tresse, An3, An4, An6, An8, An10 - Tuyaux Et Pinces - AliExpress

5e tuyau sans soudure en acier au carbone utilisé pour le pétrole et du semoir - Chine 5e tuyau sans soudure en acier au carbone, d′huile de forage

Photo libre de droit de En Aval Dun Tuyau Pour La Production De Pétrole Forage Dun Puits De Pétrole À Lintérieur Dun Appareil De Forage Le Processus De Forage Dun Puits banque

Un ingénieur de forage possède un capuchon d'extrémité pour s'adapter à un tuyau de pétrole provenant d'un puits d'exploration, faisant partie d'un réseau de puits alimentant une nouvelle installation de pétrole dans

Tuyau De Distributeur De Carburant Pour Station De Pompage De Gaz De Pétrole - Buy Tuyau De Distributeur De Carburant,Tuyau De Pompe À Pétrole,Tuyau De Pompe À Gaz Product on Alibaba.com

Tuyau flexible pour pétrole - ESSENTIAL OIL MASTER™ SD series - Gates Europe - pour fuel / pour diesel / en caoutchouc

Ensemble De Tuyaux En Acier Et En Plastique Réalistes Pour L'eau, Le Pétrole, Le Gazoduc, Le Bâtiment De Construction | Vecteur Premium

APSOparts – Gaz, gaz de pétrole liquéfié - Huile minérale, tuyau de gaz - Tuyaux - Technologie des fluides

Tuyau flexible pour produits alimentaires - POLYSPRING OIL K7560 - KURIYAMA EUROPE - pour pétrole / pour huile / en PVC

Jaune tressé tuyau tuyau PVC flexible pour gaz de pétrole de l'air de l'eau renforcé Équipements professionnels ML8287922

8415 DéVIDOIR DE TUYAU ZECA SéRIE 8400 POUR LE PéTROLE ET LE DIESEL 15 BAR TUYAU DE 8 M - DIAM INT TUYAU DE 19 MM

Polyuréthane PU Pneumatique Tuyau 4mm x 2,5mm 5 mètre Rouge Tubes Flexibles Pour Vide Air Pétrole: Amazon.fr: Bricolage

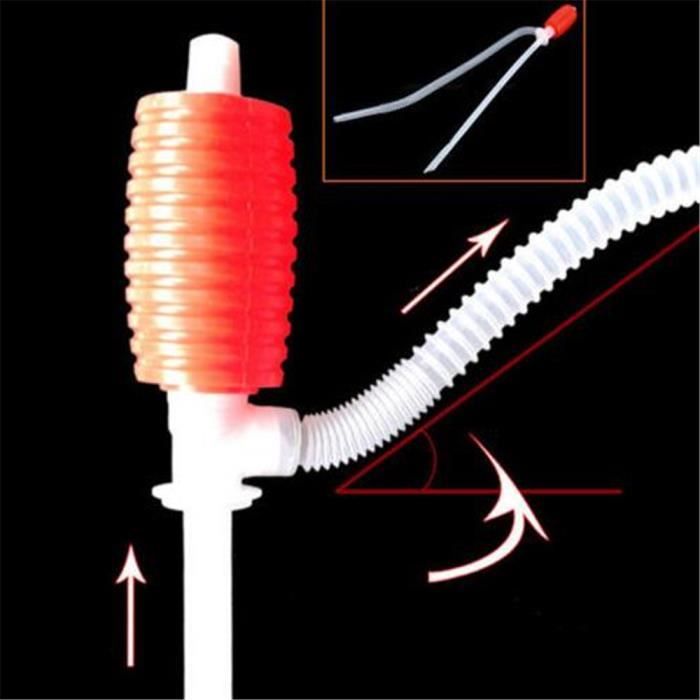

JPXyDfxn À Pile Pompe De Transfert De Liquide Avec Bendable Tuyau Pour Carburant Diesel Pétrole Gaz Eau Rouge 1pccar Siphon Tuyau Pompe Voiture : Amazon.fr: Auto et Moto

Tuyaux de camion pour station-service, pompes et barils de pétrole image libre de droit par deyangeorgiev2 © #7531581