LunetteStyle LUNETTES SOLEIL CARRÉ FEMME HOMME STYLE DISCRET NOIR MASQUE STYLE OVERSIZE XXL : Amazon.fr: Mode

Lunettes De Soleil Femme Mode Cadre Carré Personnalité Lunettes De Soleil Argent56 - Achat / Vente lunettes de soleil Mixte Neuf - Cdiscount

Lunettes Soleil Carré Homme Femme Cube Fine Marron Foncé Luxe New Vintage Old - Achat / Vente lunettes de soleil Mixte - Cdiscount

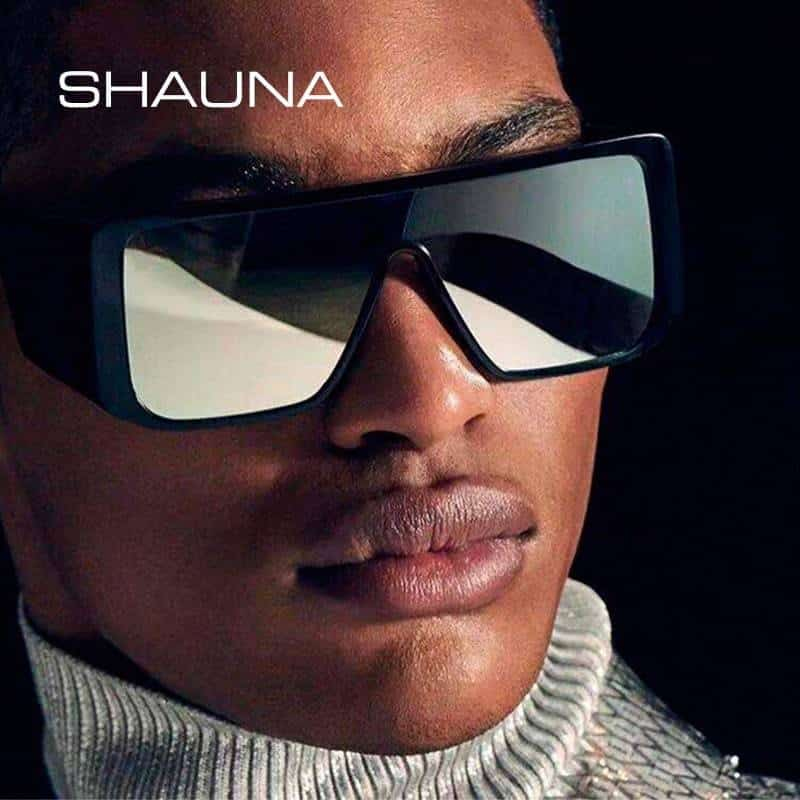

![36% OFF] 2023 Lunettes De Soleil à Cadre Carré Et Déréglé Dans Noir | ZAFUL France 36% OFF] 2023 Lunettes De Soleil à Cadre Carré Et Déréglé Dans Noir | ZAFUL France](https://gloimg.zafcdn.com/zaful/pdm-product-pic/Clothing/2021/07/09/goods-first-img/1626630009578291449.jpg?imbypass=true)