Amazon.com: Rubie's Official Disney Star Wars Jedi Hooded Robe, Deluxe Childs Size Large, Age 7-8 Years : Toys & Games

Amazon.com: Rubie's Official Disney Star Wars Jedi Hooded Robe, Deluxe Childs Size Large, Age 7-8 Years : Toys & Games

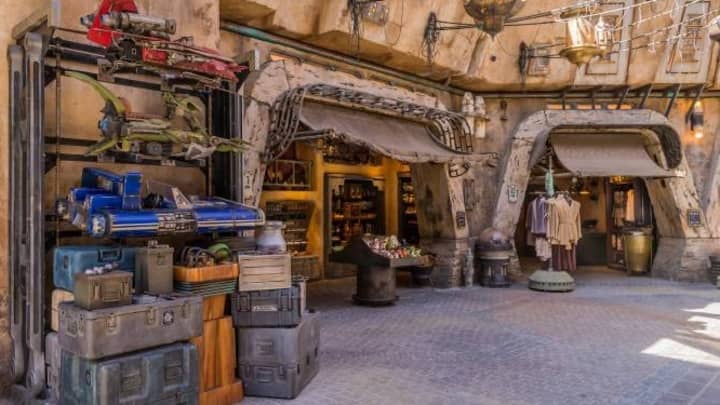

PHOTOS: Every Merchandise Item (with Prices) From Black Spire Outfitters at Star Wars: Galaxy's Edge - WDW News Today

ACT FAST! TONS of Star Wars: Galaxy's Edge Merchandise is Now Available Online! | the disney food blog

Amazon.com: Rubie's Official Disney Star Wars Jedi Hooded Robe, Deluxe Childs Size Large, Age 7-8 Years : Toys & Games

Rubies Costume Co Womens Star Wars Episode VII The Force Awakens Deluxe Rey Costume Small - Walmart.com

Amazon.com: Rubie's Official Disney Star Wars Jedi Hooded Robe, Deluxe Childs Size Large, Age 7-8 Years : Toys & Games

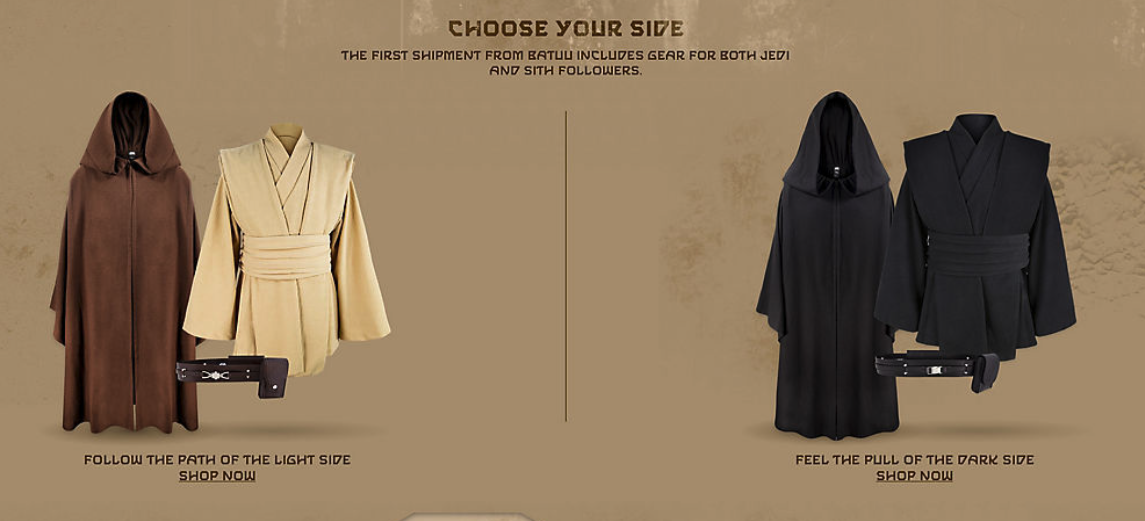

Star Wars: Galaxy's Edge Legacy Lightsabers, Jedi Robes, and More Headed to shopDisney | StarWars.com