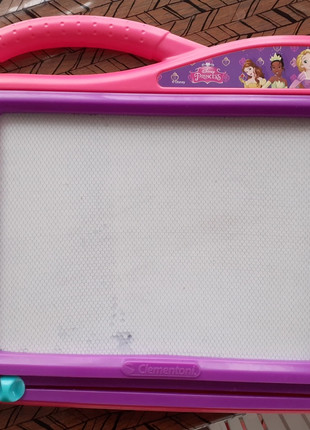

Amazon.fr : Ardoises De Gribouillage Et Griffonage - Disney / Ardoises De Gribouillage Et Gr... : Jeux Et Jouets

Amazon.fr - Disney Princesses - Mon coffret magique - Coffret coloriage et activités - Dès 5 ans - Collectif - Livres

Amazon.fr : Ardoises De Gribouillage Et Griffonage - Disney / Ardoises De Gribouillage Et Gr... : Jeux Et Jouets

Disney Princess Styling Surprise Princess 3 Pack Series 3 Mini Fashion Dolls Toy for Girls from 4 Years: Amazon.de: Toys