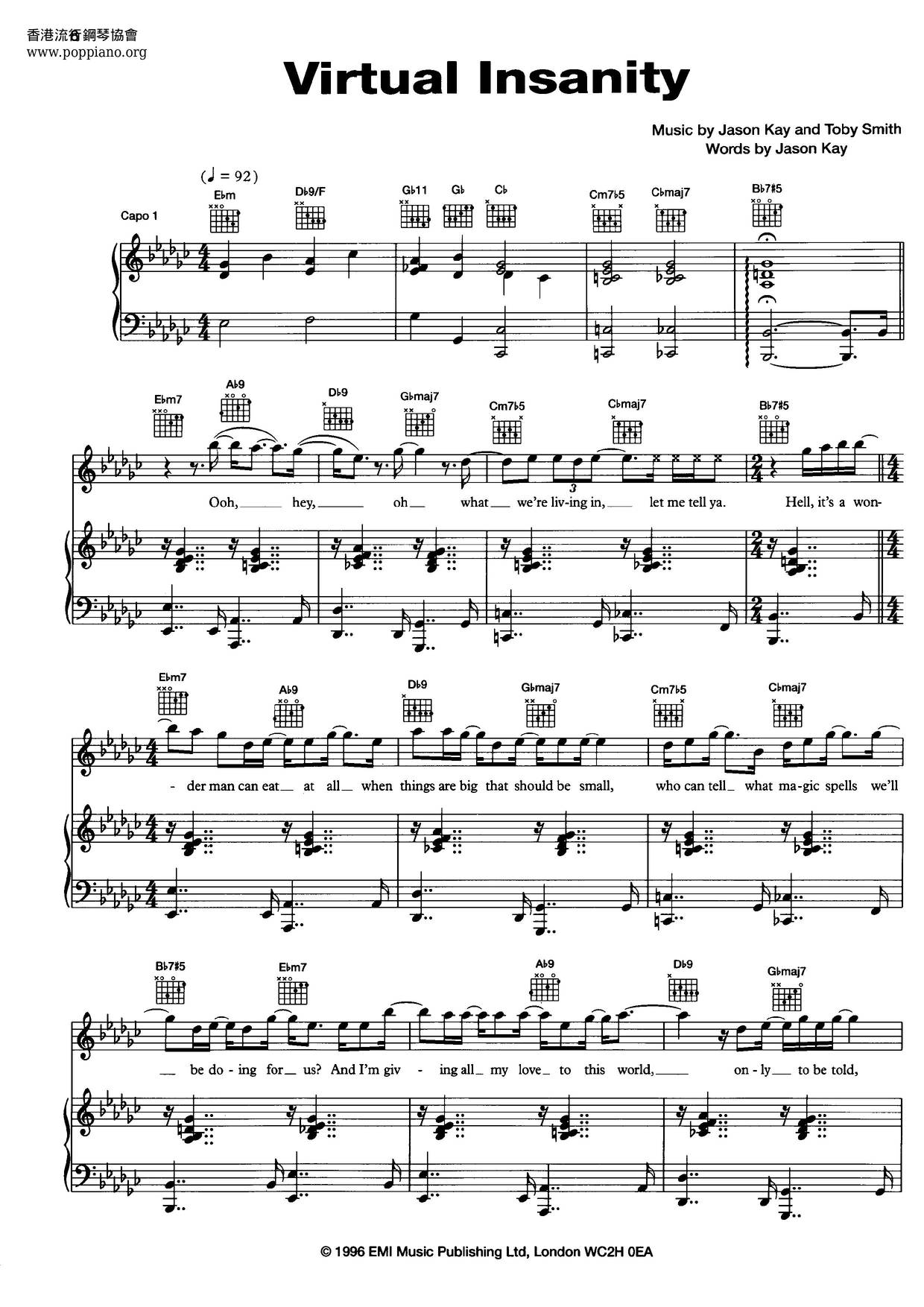

Virtual Insanity - Piano By Jason Kay And Toby Smith - Digital Sheet Music For Individual Instrument Part - Download & Print HX.202183 | Sheet Music Plus

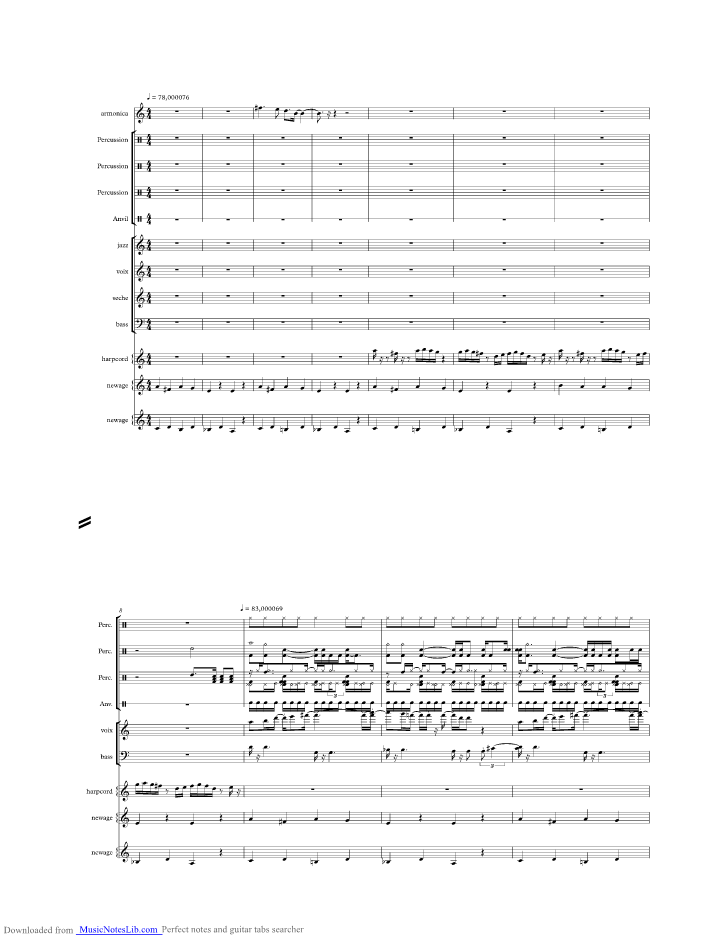

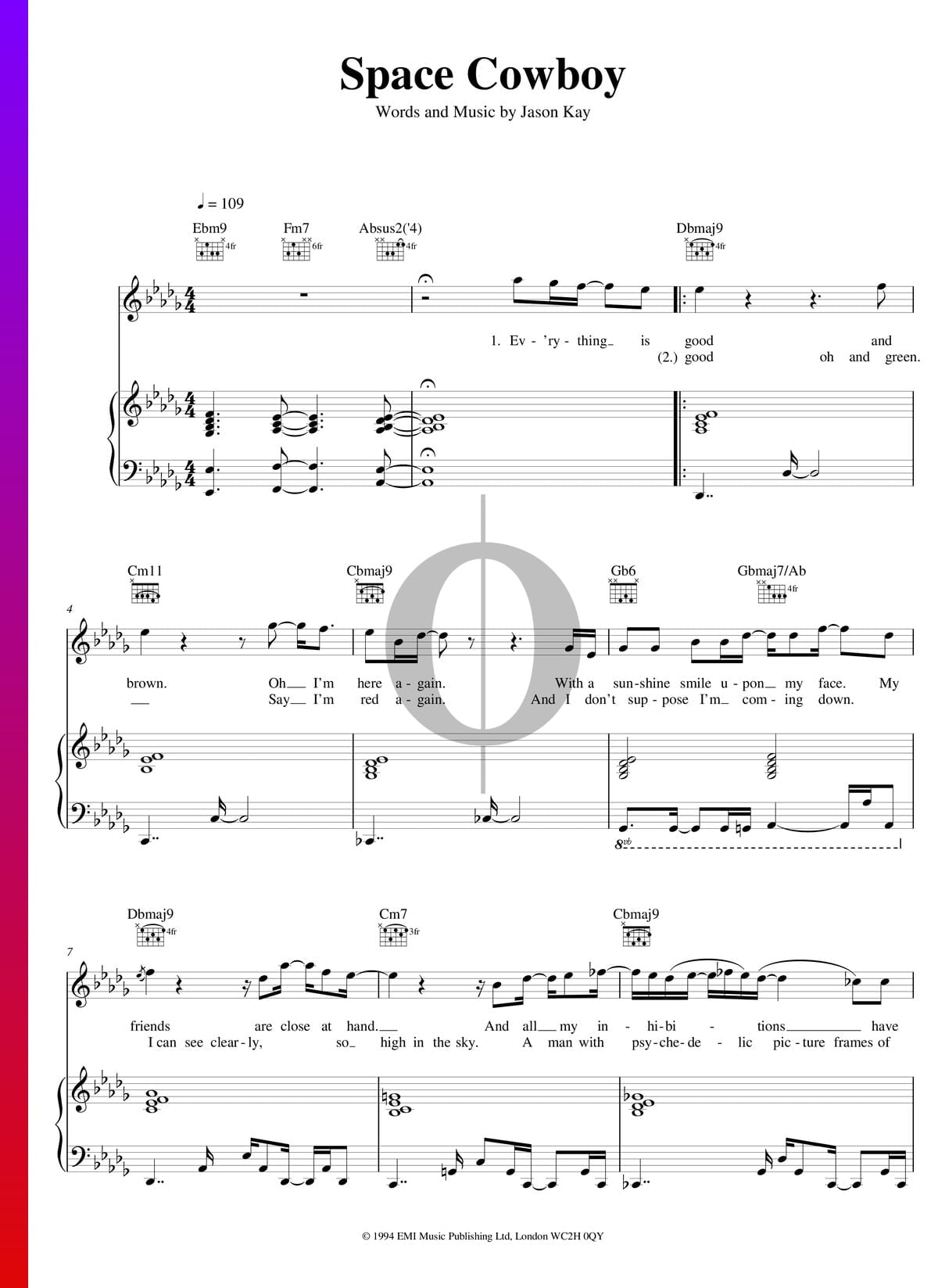

Jamiroquai "Space Cowboy" Sheet Music in Db Major (transposable) - Download & Print - SKU: MN0068224

Jamiroquai "Virtual Insanity" Sheet Music in E Minor (transposable) - Download & Print - SKU: MN0065636

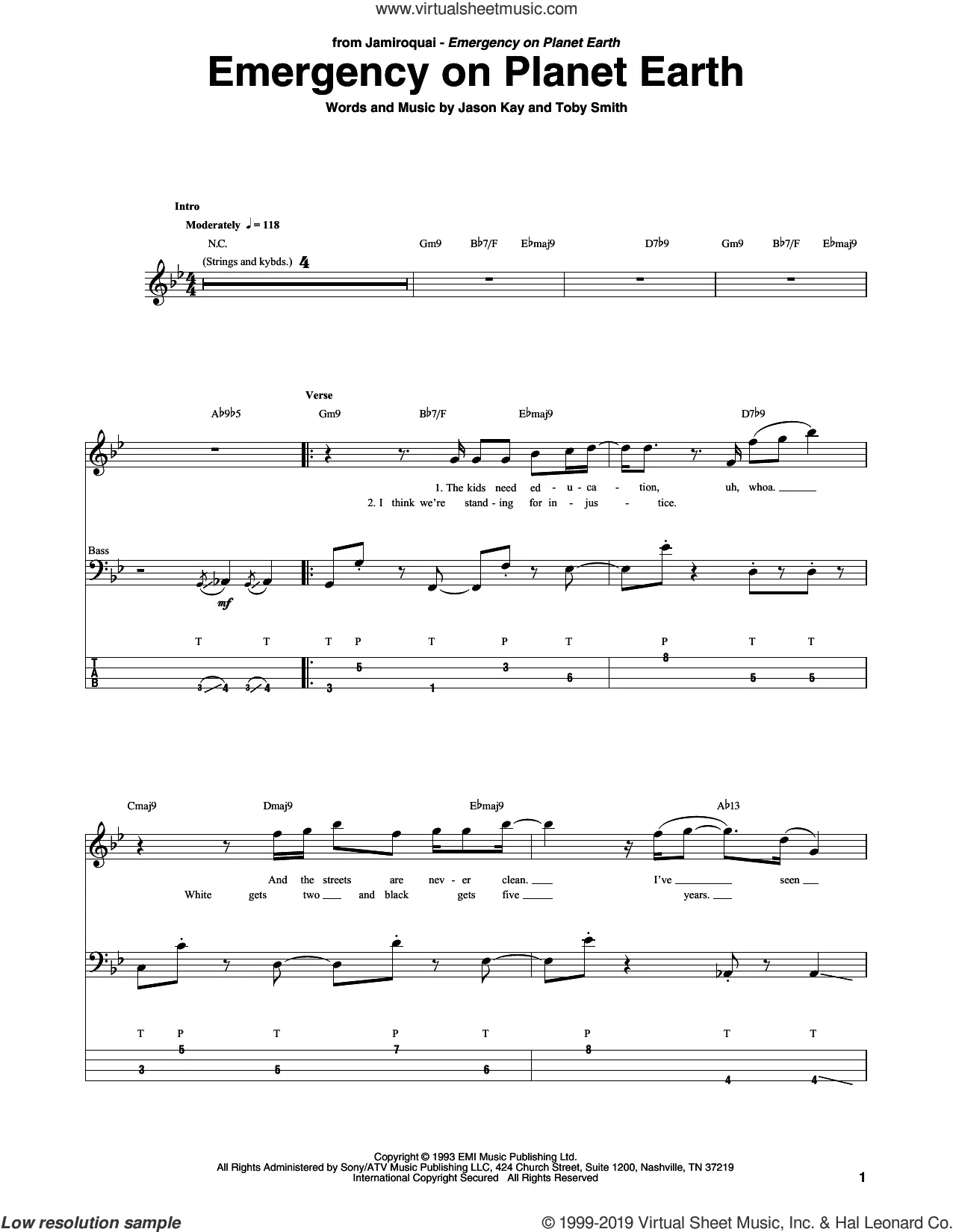

Jamiroquai "When You Gonna Learn" Sheet Music in C Minor (transposable) - Download & Print - SKU: MN0068263

![Jamiroquai - Blow your mind [Piano Tutorial] Synthesia - YouTube Jamiroquai - Blow your mind [Piano Tutorial] Synthesia - YouTube](https://i.ytimg.com/vi/BAba6zl8uTU/maxresdefault.jpg)