VFS Global no Twitter: "Effective 6 July 2020, our UK visa and HMPO services will resume in Indonesia. For details, please visit our individual country page at https://t.co/BRS0HJpi5h https://t.co/XqYJZ5534L" / Twitter

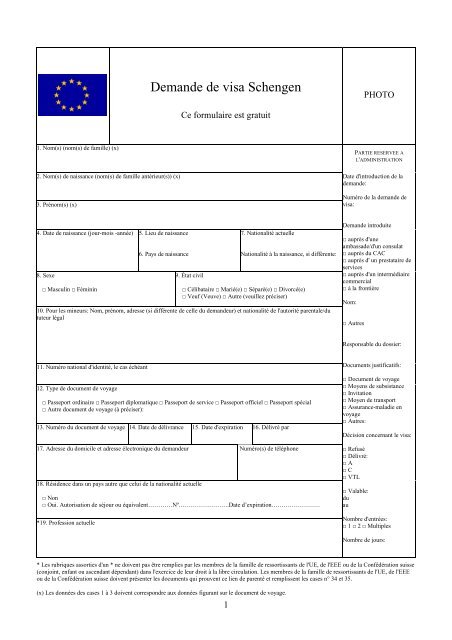

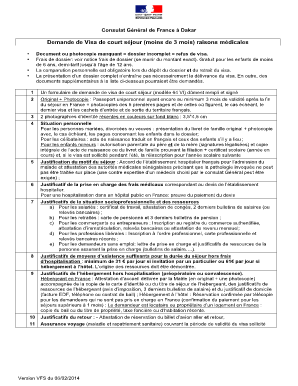

Fillable Online Demande de Visa de court s jour (moins de 3 mois ... - VFS Global Fax Email Print - pdfFiller

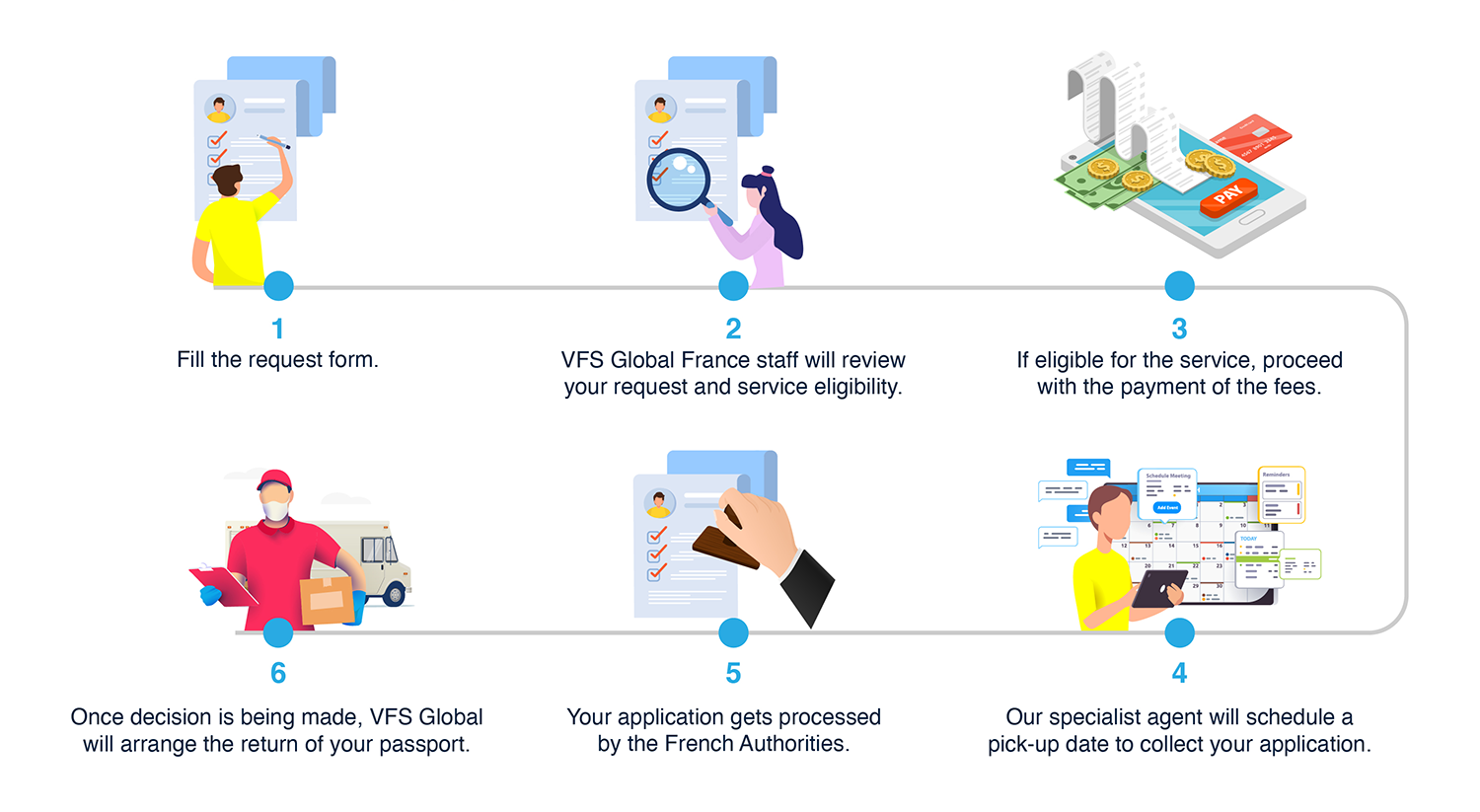

Gmail - VOTRE RENDEZ-VOUS DE DEPOT DE DEMANDE DE VISA ETUDE EN FRANCE A VFS GLOBAL | PDF | Visa (Document) | Loi sur l'immigration

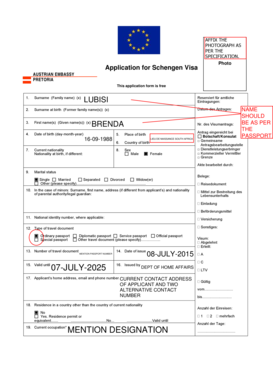

MALTA Work Visa Application by VFS Global, How to Fill Malta Work Visa Form Need by VFS Global Malta - YouTube