Copeaux de savon de Marseille - À quoi ils servent ? - Véritable savon de Marseille -Savonnerie Marseillaise

Vente en ligne Savon de Marseille en copeaux ou paillettes pur olive, acheter Savon de Marseille en copeaux ou paillettes pur olive sur Droguerie Jary

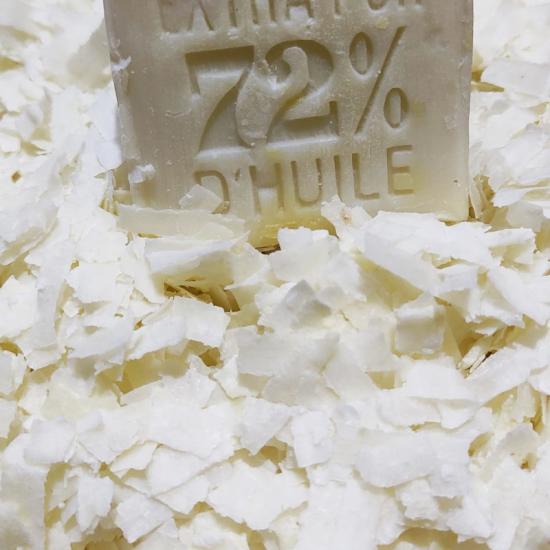

Copeaux de Savon de Marseille 1 KG - Sans Parfum - Lessive au Savon de Marseille - Fabrication Artisanale par Le Serail depuis 1949 : Amazon.fr: Epicerie

Sac de jute de copeaux de savons de Marseille Huiles végétales (500g) - Savonnerie Provençale : Boutique véritable Savon de Marseille, savon bio, savon noir, savon de marseille, savon veritable, savon vegetal,