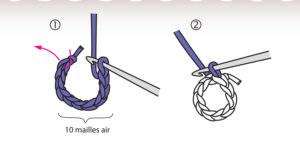

▷ Comment faire un cercle magique au crochet ? Nouvelle méthode ! | Modèles de crochet pour débutants, Cercle magique, Modèles de crochet

▷ Comment faire un anneau magique ? Tutoriel crochet cercle magique | Tutoriel crochet débutant, Modèles de crochet, Tutoriel crochet gratuit