Various XBox 360 Games - GTA IV, Homefront, COD BO III, COD 4 MW, Video Gaming, Video Games, Xbox on Carousell

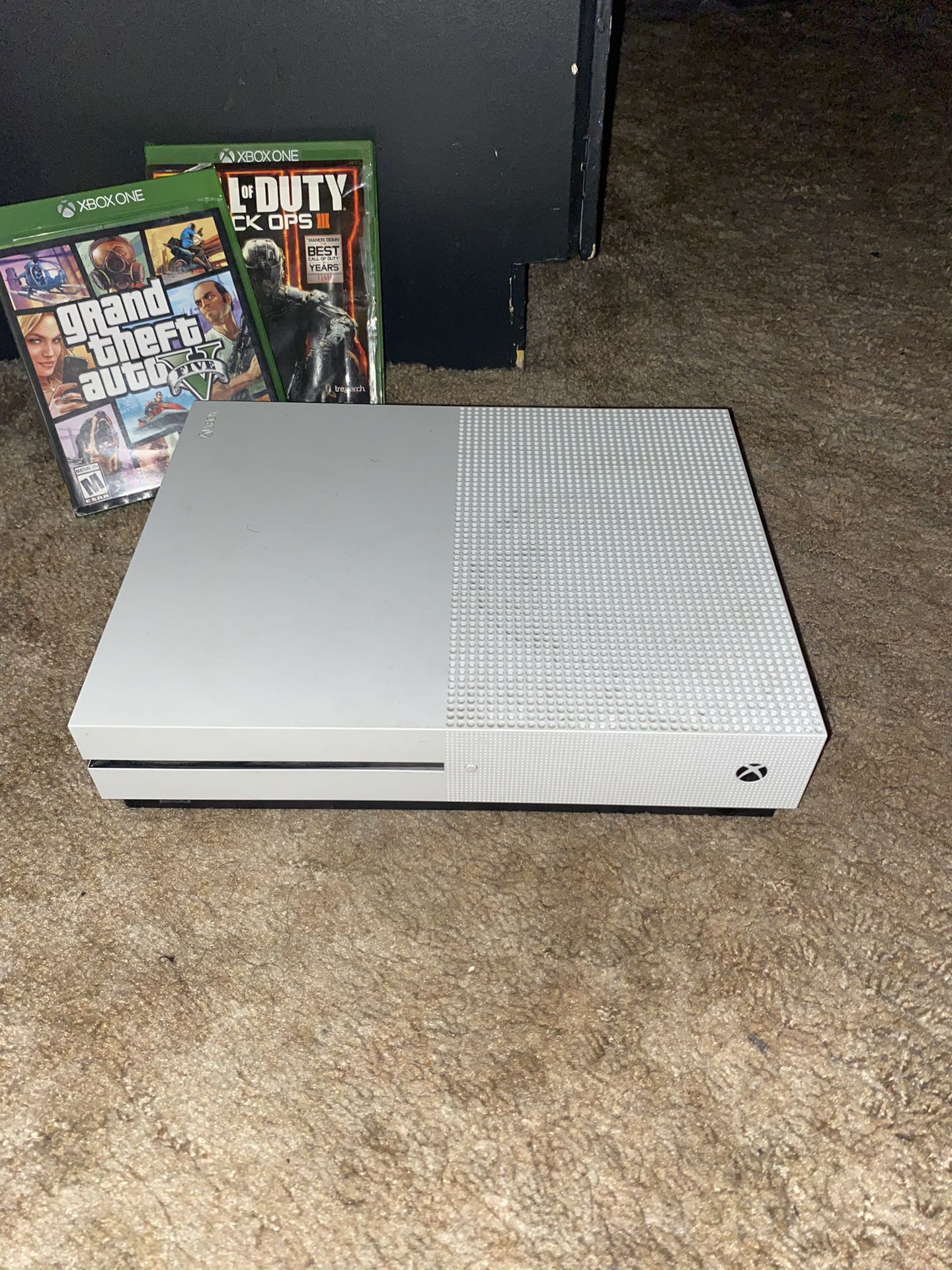

234-00051 Xbox One S White 1TB Gaming Console with Call of Duty- WW2 BOLT AXTION Bundle Used - Walmart.com

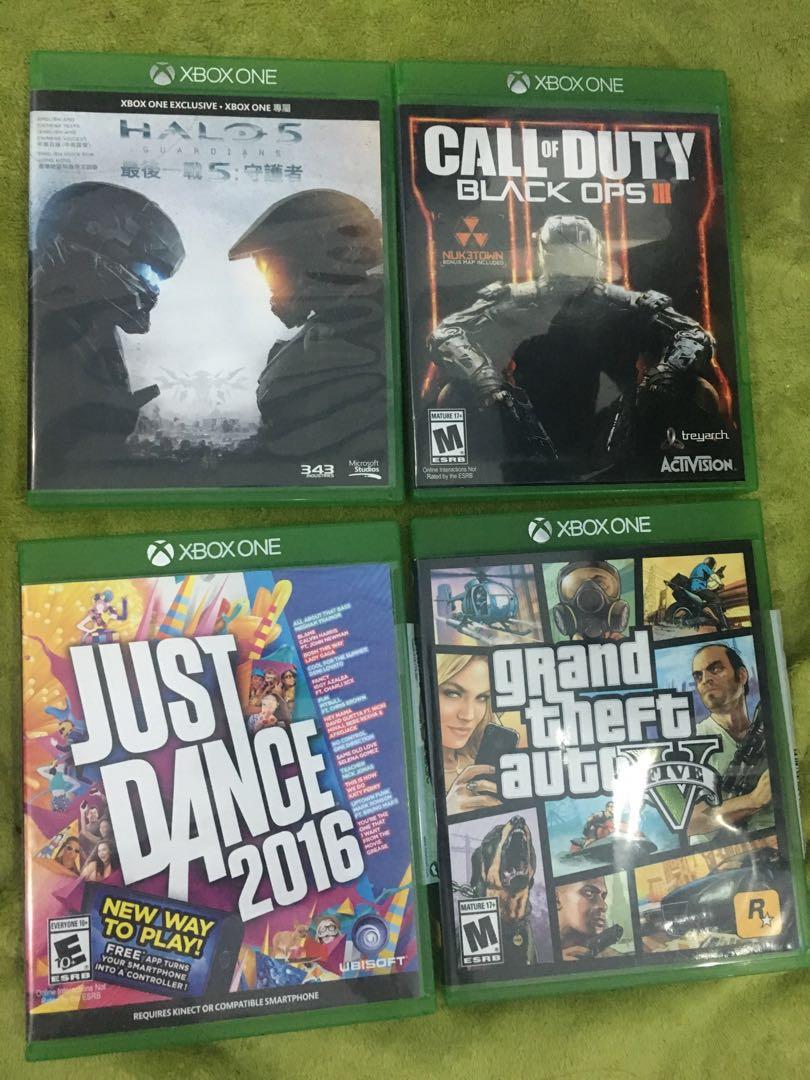

Joc GTA V Premium Online Edition & Great White Shark Card Bundle Xbox ONE EU Xbox Live Key Europe (Cod Activare Instant) - eMAG.ro

Amazon.com: Call of Duty: Black Ops III - Standard Edition - Xbox 360 : Call of Duty: Black Ops 3: Video Games