Savon noir nigérian teint clair marron. Anti tâche anti vergetures anti acné, rajeunit et fait briller le teint - Cdiscount Au quotidien

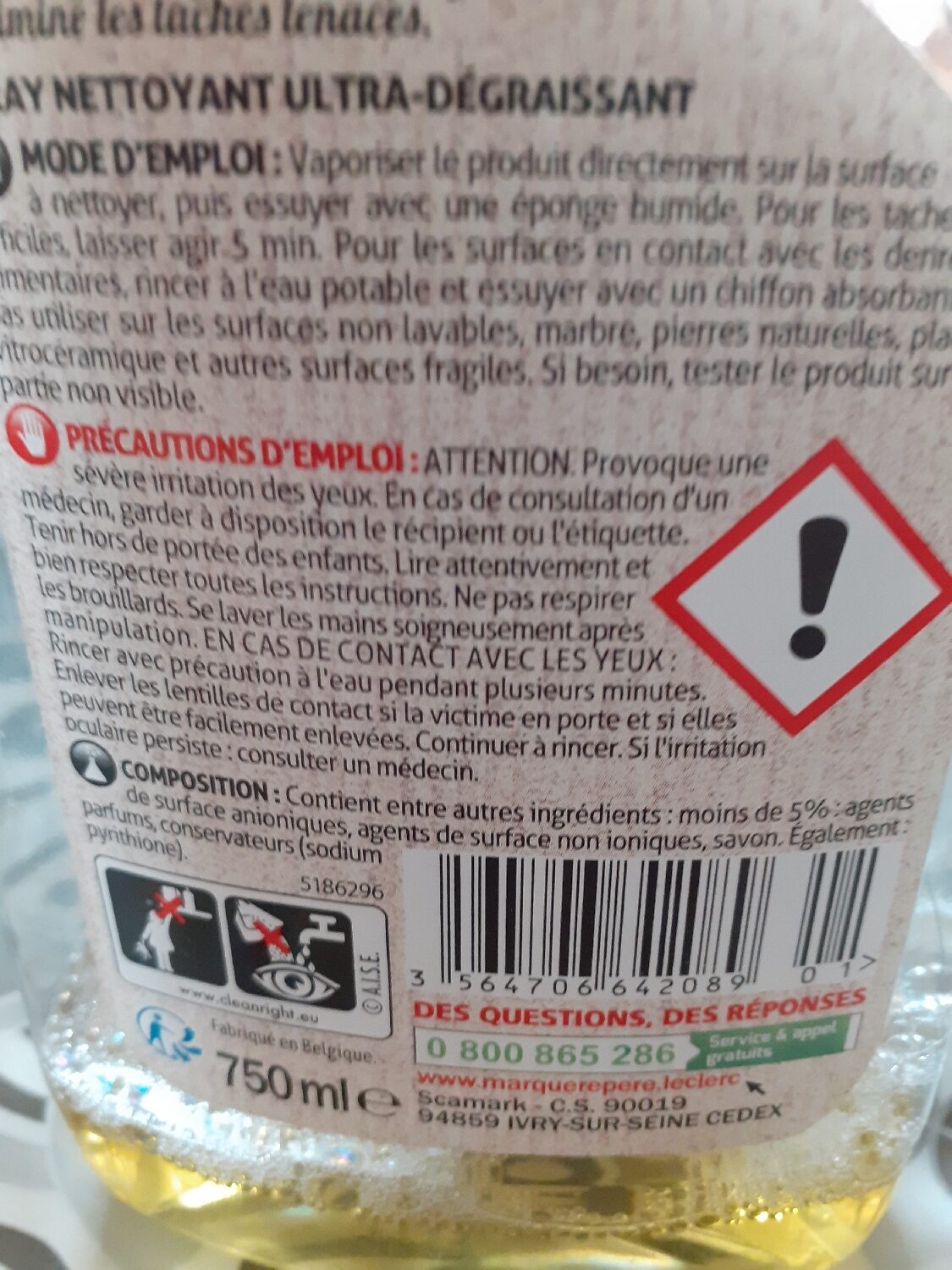

Test Clair (E.Leclerc) Multi-surfaces au savon noir fleur d'oranger - Nettoyants ménagers en spray - UFC-Que Choisir

Savon Noir liquide Prêt à l'emploi - Multi-usage - 500 ml - Savon noir liquide prêt à l'emploi - Multifonction : Amazon.ca: Beauté

Nettoyant sol carreles clair savon huile de lin 1l - Tous les produits entretien de la maison - Prixing