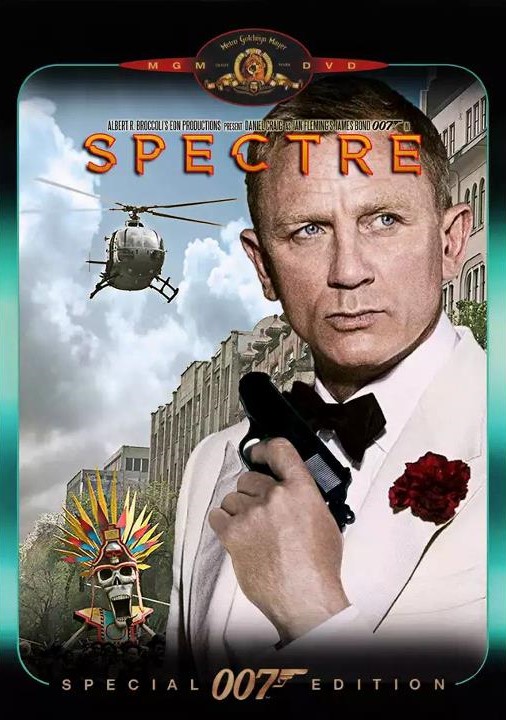

Spectre (2015) dvd cover - DVD Covers & Labels by Customaniacs, id: 233201 free download highres dvd cover

![Spectre Dvd Cover - James Bond: The Ultimate Collection [book] - Free Transparent PNG Download - PNGkey Spectre Dvd Cover - James Bond: The Ultimate Collection [book] - Free Transparent PNG Download - PNGkey](https://www.pngkey.com/png/detail/404-4042087_spectre-dvd-cover-james-bond-the-ultimate-collection.png)

Spectre Dvd Cover - James Bond: The Ultimate Collection [book] - Free Transparent PNG Download - PNGkey

James Bond on Twitter: "#SPECTRE available to own on Digital HD Jan 22 and Blu-ray & DVD on Feb 9 (USA) and on Feb 19 and Feb 22 in the UK https://t.co/psIPc1RO8G" /

![Spectre [DVD] [2015]: Amazon.co.uk: Daniel Craig, Christoph Waltz, Lea Seydoux, Ben Whishaw, Naomie Harris, Rory Kinnear, Dave Bautista, Monica Bellucci, Andrew Scott, Ralph Fiennes, Sam Mendes, Daniel Craig, Christoph Waltz: DVD & Spectre [DVD] [2015]: Amazon.co.uk: Daniel Craig, Christoph Waltz, Lea Seydoux, Ben Whishaw, Naomie Harris, Rory Kinnear, Dave Bautista, Monica Bellucci, Andrew Scott, Ralph Fiennes, Sam Mendes, Daniel Craig, Christoph Waltz: DVD &](https://m.media-amazon.com/images/I/81kus1J+yKL._AC_SL1500_.jpg)

![Mgm/ua Home Video Spectre DVD [Blu-ray] Widescreen Daniel Craig - Walmart.com Mgm/ua Home Video Spectre DVD [Blu-ray] Widescreen Daniel Craig - Walmart.com](https://i5.walmartimages.com/asr/8692367e-4b7c-4025-abbc-005556bcbf54.f62272fb01ceb7a04368ecf08bfd671f.jpeg?odnHeight=612&odnWidth=612&odnBg=FFFFFF)

![No Time to Die [DVD] [2021] - Best Buy No Time to Die [DVD] [2021] - Best Buy](https://pisces.bbystatic.com/image2/BestBuy_US/images/products/3541/35414516_so.jpg)