Adidas Originals X Jeremy Scott – Roundhouse Mid “Handcuffs” – A Polêmica | SneakersBR - Lifestyle Sneakerhead

jeremy scott adidas originals roundhouse mid handcuff | Apgs-nswShops - adidas premium tee 'Crystal White' - BY8955

Adidas Deerupt Runner 'Cloud White Red' adidas Originals adilette Lite Svarta tofflor DB2686 | adidas ultra boost grey white | KICKSCREW

Sneakers adidas Originals Gazelle J Purple for Junior | RvceShops | adidas scraps handcuffs js roundhouse mid | HP2897

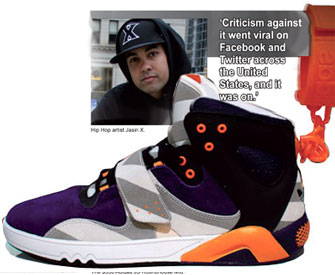

jeremy scott x adidas originals js roundhouse mid handcuff - High Quality OG Yeezy look Boost 380 Blue Oat - StclaircomoShops

Adidas Originals X Jeremy Scott – Roundhouse Mid “Handcuffs” – A Polêmica | SneakersBR - Lifestyle Sneakerhead

HotelomegaShops - adidas caves to public outcry and scraps the controversial Handcuff Roundhouse Mids - ADIDAS ZX4000 4D "HENDER SCHEME WHITE"

:quality(70)/arc-anglerfish-arc2-prod-tronc.s3.amazonaws.com/public/R6DPDO2QILRSITWPLTDYFKXI5E.jpg)