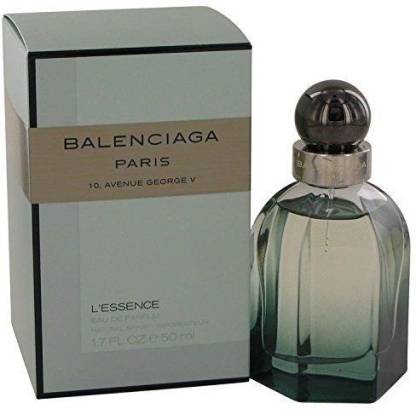

Amazon.com : Balenciaga Paris L'essence 2 Piece Gift Set for Women, 2.5 Ounce : Fragrance Sets : Beauty & Personal Care

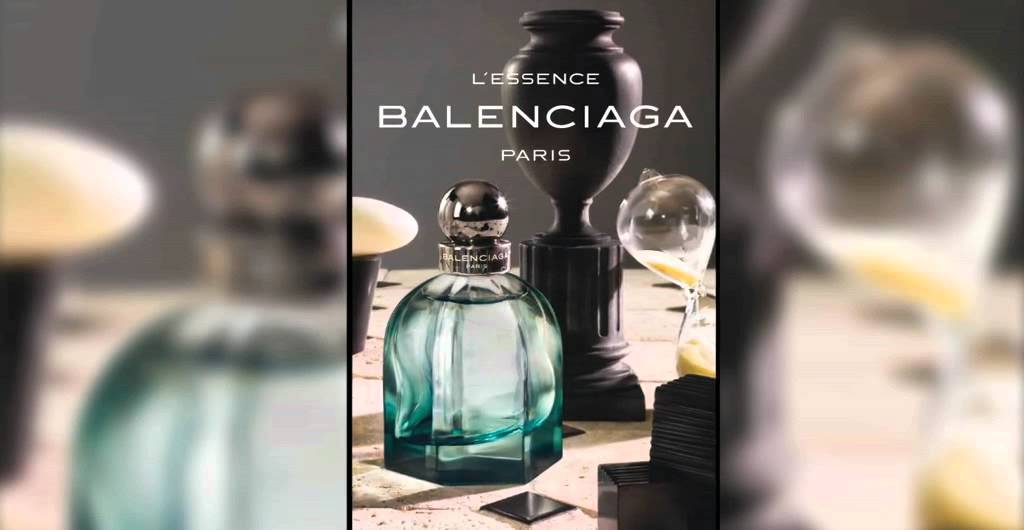

BALENCIAGA L'ESSENCE Women Perfume 0.04oz-1.2ml EDP Spray Sample Vial (C76 | eBay | Women perfume, Vials, Fragrance

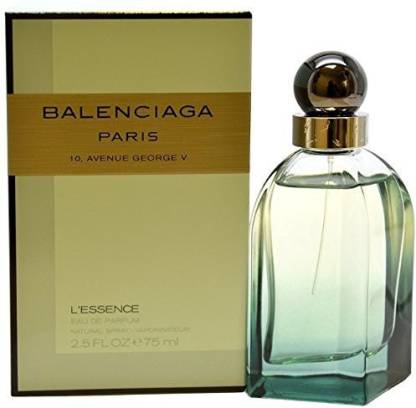

Buy BALENCIAGA Paris L'Essence Eau De Parfum Spray for Women, 2.5 Ounce Eau de Parfum - 75 ml Online In India | Flipkart.com